ARAG Group Defies COVID-19 Crisis Recording Significant Growth

Published on 13/05/2021

"Legal insurance is a crisis product. The key figures show: We deliver real added value for our customers and are in control of our business. ARAG is gaining significant new customers and at the same time is operating the business with growing profitability," explained Dr. Renko Dirksen, Spokesman of the Management Board of ARAG SE at the annual press conference of the ARAG Group.

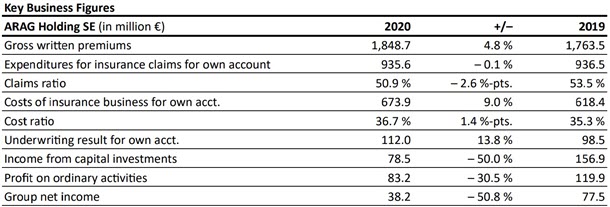

The ARAG Group increased its gross premium income in 2020 by 4.8 percent from €1.76bn (A$2.75bn) to €1.85bn (A$2.89bn). Consolidated turnover – including revenue from service companies – came to €1.87bn (A$2.9bn). The underwriting result again improved significantly by 13.8 percent, reaching a new record level of €112.0m (A$175m). Income on ordinary activities was €83.2m (A$130m).

Despite the pandemic crisis, the ARAG Group posted significant growth in Germany in 2020. Premium income rose by 6.1 percent exceeding the market average. Growth in international business was rather moderate at 3.1 percent due to the obvious sharp decline in the travel-related Special Service Package business. International legal insurance business, on the other hand, continued to grow with premium growth of 6.8 percent. At the end of 2020, the ARAG Group had a total of 10.5 million policies in its portfolio. The Group's combined ratio improved further to 87.6 percent, down from 88.7 percent in 2019, while claims expenses were on a par with the previous year at €935.6m (A$1.5bn). As a result of the strong premium growth, the Group claims ratio thus decreased significantly from 53.5 percent to 50.9 percent. The cost ratio increased from 35.3 percent to 36.7 percent as a result of the dynamic growth. At €78.5m (A$122m), income from capital investments was back at the normal level of previous years. The 2019 figure had been twice as high on account of a very favorable market development and special effects. As expected, the profit on ordinary activities of €83.2m (A$130m) was clearly below the previous year's figure of €119.9m (A$187m) (which was due to special effects). Group equity capital rose slightly to €574.2m (A$896.7m) (previous year: €558.1m (A$871.6m)).

The record high in premium income is primarily attributable to the strong legal insurance segment - the largest unit in the Group. Here, premium growth was 5.8 percent in Germany and 6.8 percent in international business. The health insurance segment delivered a particularly strong premium gain of 9.4 percent, mainly driven by the successful new full-coverage health insurance rates. The composite segment posted a decrease of 7.6 percent, mainly due to the negative effects of the pandemic on the international Special Service Package business.

Outlook for the current business year 2021

The very positive business development is continuing in 2021. Premium income rose by 7.4 percent in the 1st quarter to €575.8m (A$899m) (previous year: €536.1m (A$837m)). As a consequence, the Group recorded its best start to the year ever. In the German market, revenues increased by 7.3 percent. The legal insurance business posted a 6.9 percent increase. The health insurance business continued its dynamic growth course with revenue gains of 11.3 percent. International business delivered an additional 8.5 percent in premiums in the 1st quarter.

"In conclusion we can say that the ARAG Group is a company on the move at the beginning of the new decade. We continue to pursue ambitious objectives, remain hungry for success. The pandemic crisis has done nothing to change this. On the contrary: we perform and we deliver. ARAG is expanding its customer base significantly even under difficult conditions – both nationally and internationally," emphasized Dr. Renko Dirksen. The Group’s business idea is modern and timeless. The idea will gain additional relevance in the coming years in light of "People Centered Justice" enshrined in the idea of sustainable transformation, the ARAG Group Board Spokesman explained. He refers in particular to Development Goal 16 of the UN Sustainable Development Goals, in which the UN has stipulated that all people must be granted equal access to justice. "Our identification with this goal is immediate. It is, after all, the ARAG founding idea of Heinrich Faßbender. If this idea of legal insurance did not already exist, it would have to be reinvented today to achieve global sustainability goals," said Dr. Renko Dirksen.

Disclaimer - all information in this article was correct at time of publishing.

Exchange rate Euro to Australian Dollar per 13.05.2021.

ARAG Services Australia Pty Ltd (ABN 14 627 823 198) (ARAG) has been granted delegated authority by the Insurer to enter into, vary or cancel Policies and handle Claims on their behalf. In providing these services, ARAG acts on behalf of the Insurer and not as Your agent. ARAG is authorised to provide financial services in accordance with its Australian Financial Services Licence (AFS Licence number 513547). Any advice provided by ARAG in relation to this product is general in nature and does not take into account Your individual circumstances.

The Insurer is detailed in your policy documents.

All enquiries should be addressed to ARAG.

Any advice contained on this website is general advice only and has been prepared without considering your individual objectives, financial situation or needs. Before purchasing or renewing a product we recommend that you consider if it is suitable for your circumstances and read the policy terms and conditions.