Extraordinary success for the ARAG Group in Business Year 2019

The ARAG Group looks back today on the most successful business year in its history. We achieved a marked improvement on the very good results of the preceding years. ARAG is positioned for sustained successs," explained Dr. Paul-Otto Faßbender, Chairman of the Board of Management and majority shareholder of the ARAG Group, at the annual press conference. Due to the COVID-19 pandemic, this year's annual press conference was conducted by telephone.

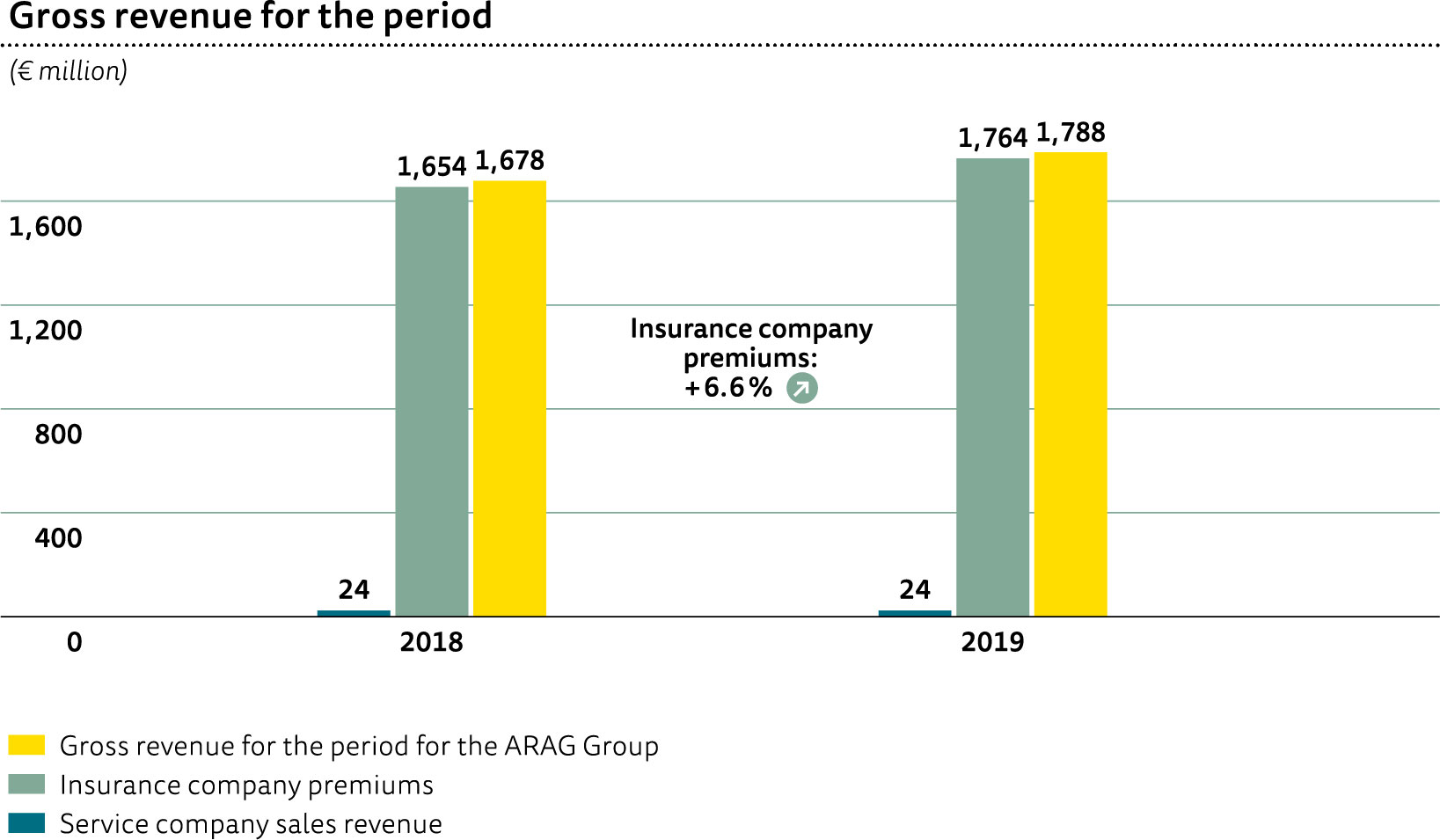

ARAG Group reported gross written premium income of € 1.76 billion as compared to € 1.65 billion in 2018. That amounts to a gain of € 110 million or 6.6 percent. Consolidated turnover - including revenue from ARAG service companies - came to € 1.79 billion. The underwriting result reached another ten-year high at € 98.5 million. Profit on ordinary activities rose sharply by 70.7 percent to € 119.9 million. With net after-tax income of € 77.5 million, ARAG achieved the best result in its history.

The effects of the COVID-19 pandemic were explained by Dr. Renko Dirksen. He will assume the position of Speaker of the Management Board for ARAG SE effective 4 July 2020. Dr. Paul-Otto Faßbender’s tenure as Chairman of the Management Board of ARAG SE will end as planned on that date.

Further information on the annual press conference can be found below in the press release and in the statement.

ARAG Services Australia Pty Ltd (ABN 14 627 823 198) (ARAG) has been granted delegated authority by the Insurer to enter into, vary or cancel Policies and handle Claims on their behalf. In providing these services, ARAG acts on behalf of the Insurer and not as Your agent. ARAG is authorised to provide financial services in accordance with its Australian Financial Services Licence (AFS Licence number 513547). Any advice provided by ARAG in relation to this product is general in nature and does not take into account Your individual circumstances.

The Insurer is detailed in your policy documents.

All enquiries should be addressed to ARAG.

Any advice contained on this website is general advice only and has been prepared without considering your individual objectives, financial situation or needs. Before purchasing or renewing a product we recommend that you consider if it is suitable for your circumstances and read the policy terms and conditions.